Business Insurance in and around Newtown

Newtown! Look no further for small business insurance.

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

When you're a business owner, there's so much to remember. We get it. State Farm agent Sarah De Jesus is a business owner, too. Let Sarah De Jesus help you make sure that your business is properly protected. You won't regret it!

Newtown! Look no further for small business insurance.

Almost 100 years of helping small businesses

Keep Your Business Secure

Whether you are a dog groomer a photographer, or you own a hobby shop, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Sarah De Jesus can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and computers.

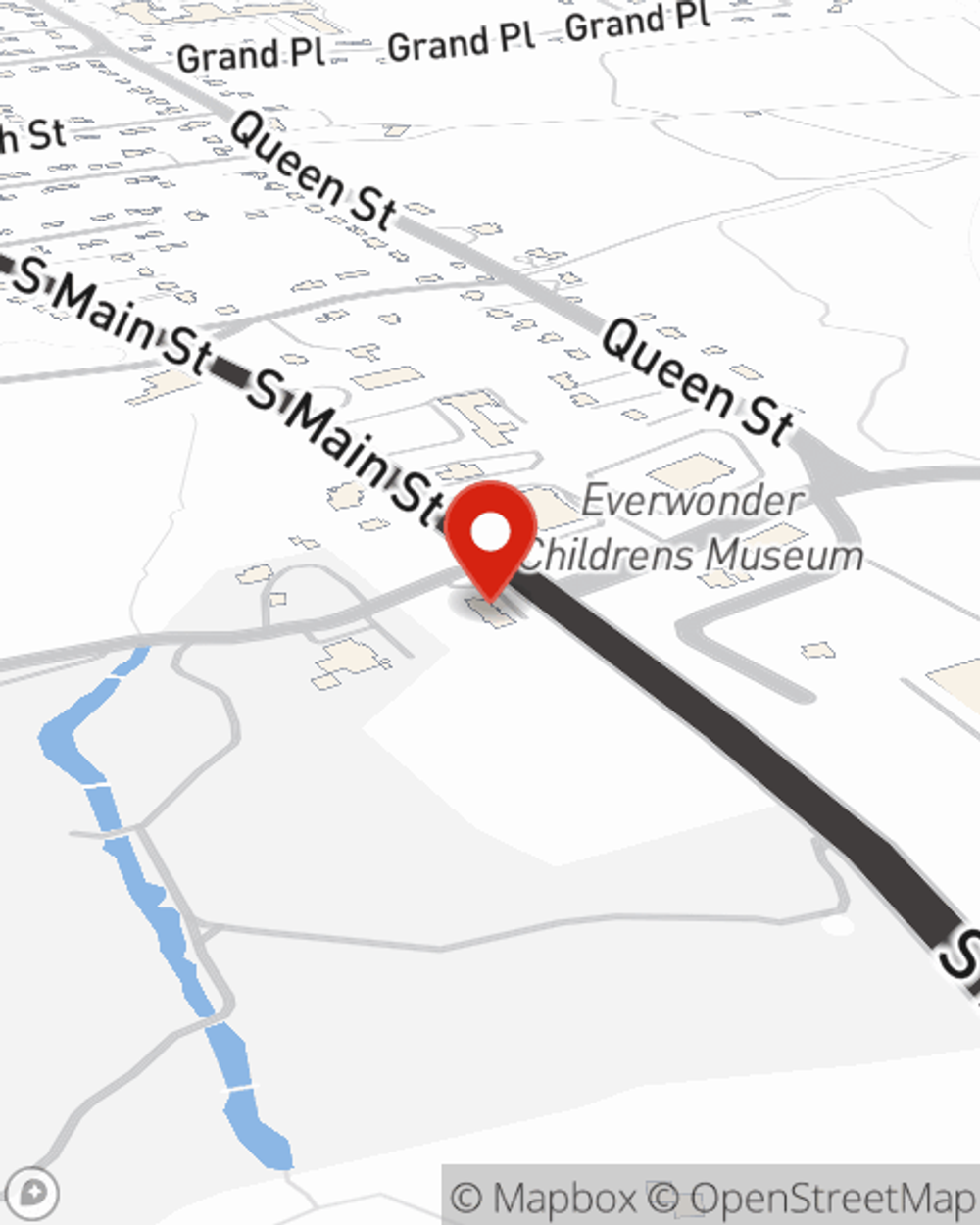

Reach out to State Farm agent Sarah De Jesus today to learn more about how the trusted name for small business insurance can ease your worries about the future here in Newtown, CT.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sarah De Jesus

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.